Our 2023 performance

An overview of Ageas's outstanding business performance in 2023 and new achievements under Impact24.

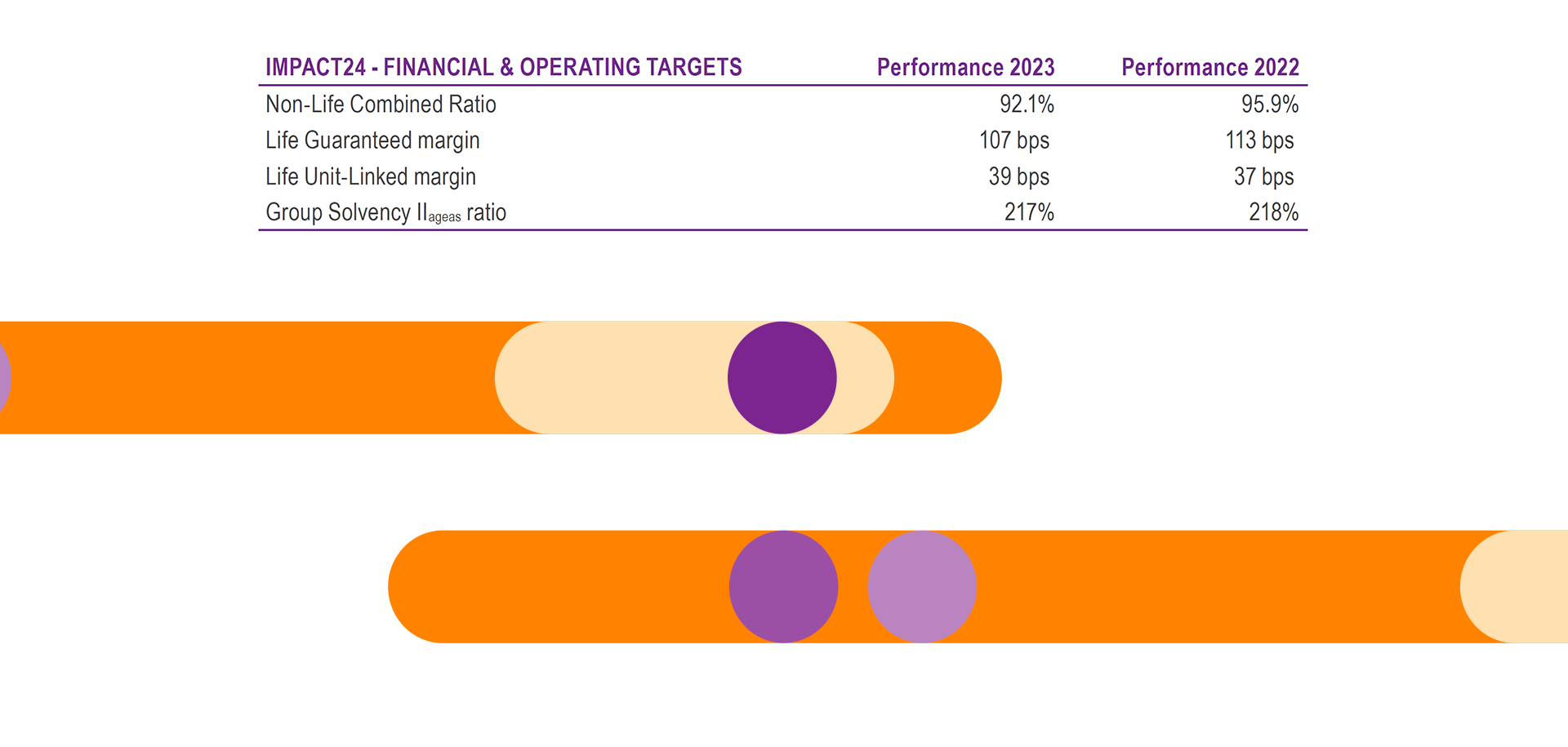

Financial & Operational performance

Ageas delivered a strong commercial performance in 2023. Group inflows were 8% up at constant exchange rates compared to last year amounting to EUR 17.1 billion. Growth in Life inflows was particularly strong in China, driven by new business sales in the first half year ahead of the regulatory pricing rate change coming into place in the second half year, and solid renewals in the last six months of the year. In Belgium and Portugal customer appetite for Life insurance products was impacted by the higher interest rates and changed dynamics with short term banking products. The actions taken in the first half to strengthen the commercial position proved successful during the final months of the year. The Life Liabilities excluding UG/L grew 5% to EUR 84.7 billion at constant exchange rates. Non-Life inflows were up 17% at constant exchange rates with growth across all segments, driven by portfolio growth and price increases in response to increased inflation. The third-party Reinsurance business successfully completed the 1 January 2024 renewal period.

The Net Operating Result for the Group amounted to EUR 1,166 million, representing a 16.2% Return on Equity and falling well within the upper half of the initial guidance of EUR 1.1 billion to EUR 1.2 billion. At constant exchange rates, this represents a 9% increase compared to last year’s Net Operating Result excluding the capital gains related to the sale of the commercial lines in the UK and the FRESH liability management action.

The Guaranteed margin of 124 bps and the Unit-Linked margin of 39 bps in Life were driven by a strong underwriting performance, with the Life operating insurance service result up 6% compared to last year. The Life Net Operating result was EUR 894 million, driven by a strong underwriting performance across all segments reflecting the quality of the Life business.

The Non-Life combined ratio of 93.3% is driven by a favourable claims experience across all product lines, supported by relatively benign weather in 2023 and an improved expense ratio. This translated into a Non-Life Net Operating Result of EUR 389 million, more than double that of last year, excluding the capital gain realised on the sale of the commercial lines in the UK in 2022.

The Life Contractual Service Margin (CSM) amounted to EUR 9.3 billion with a New Business contribution to the CSM of EUR 805 million. The Operating CSM movement amounted to EUR 309 million, representing an increase of 3.2%, mainly driven by Asia.

The Comprehensive equity, comprising the sum of the Shareholders’ equity of EUR 7.4 billion, the unrealised gains and losses on real estate and the CSM of the Life business, stood at EUR 15.6 billion or EUR 85.04 per share. The contribution from the Net Operating Result and Net Operating CSM movement was offset by the payment of the final 2022 dividend and unfavourable exchange rate evolution.

Ageas’s Solvency II Pillar II ratio amounted to a strong 217%, largely above the Group’s target of 175% and broadly in line with the level of 218% at the end of the 2022, as the additional required capital from the strong sales momentum in Non-Life and reinsurance was fully compensated by the proceeds of the sale of the business in France. The solvency of the non-Solvency II scope companies increased significantly to 282%, up 74 percentage points compared to the end of 2022, largely driven by strengthening measures implemented in China.

The Operational Capital Generation over the period stood at EUR 1.8 billion, illustrating a solid operating performance across the Group and confirming the strong Net Operating Result. This included EUR 857 million generated by the Solvency II scope companies, and EUR 1,116 million from the Non-Solvency scope entities, while the General Account consumed EUR 169 million.

Operational Free Capital Generation, including both the Solvency II and the non-Solvency II scope, amounted to EUR 1.2 billion.

In my first full year as CFO of Ageas, I’m very proud of the solid operating performance our entities achieved across the Group, allowing us to deliver on our engagements towards the investor community with Net Operating Results within the upper half of our initial guidance, and a proposed dividend increase fully in line with the growth trajectory included in our Impact24 commitments.

Wim Guilliams, CFO Ageas

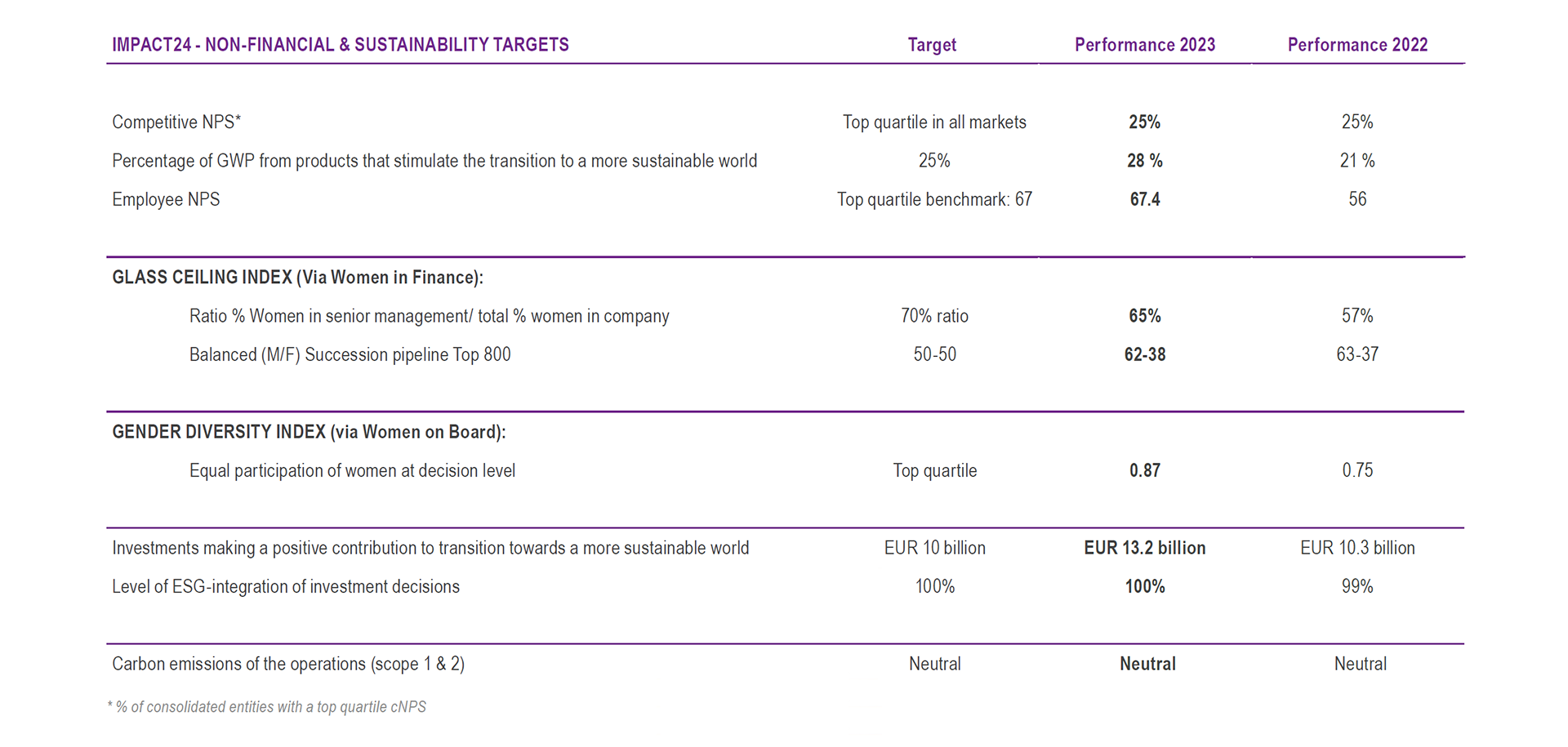

Non-financial & Sustainability Performance

In the second year of Impact24, Ageas continued to make significant steps toward its non-financial and sustainability objectives. These efforts resulted in improved ratings from five out of the six ESG rating agencies that assess the Group’s performance. Additionally, Ageas launched numerous initiatives aimed at reinforcing its core business, enhancing the various distribution channels, elevating the customer experience, and seamlessly integrating new technologies into its operations.

Regarding to the non-financial targets, we expanded the number of entities where the Group assesses the competitive Net Promoter Score (NPS) to ten. We exceeded our target by achieving a higher percentage -28% - of products that qualify for the 25% of Gross Written Premium (GWP) objective of products actively contributing to the transition toward a more sustainable world. Our investments making a positive impact on sustainability have grown to EUR 13.2 billion, surpassing the ambition set for 2024. Lastly, we’ve made good progress across all people kpi’s in line with our ambition to create a “Great place to Grow” for our employees.

In setting clear non-financial and sustainability targets as part of our Impact24 strategy we deliberately wanted to capture and hold ourselves accountable for those elements of our performance that were not traditionally visible in the core financials but are increasingly important to who we are as a company, and our impact in this world. This year showed strong results reflected in improved ESG ratings and reaching some of our non-financial and sustainability targets one year ahead of plan. At the same time, we launched a number of new initiatives to improve the customer experience, expand our distribution reach and increase our efficiency through the use of new technologies and new types of partnerships. So, we can be happy with our progress and all teams are highly engaged with more still to do.

Gilke Eeckhoudt, CDSO Ageas